I Tried Running a Hedge Fund

January 14, 2018

It was February 2017. Warren Buffett’s new documentary had just come out, there was no way I was going to miss that.

Apart from the golden nuggets of wisdom he kept dropping throughout the film, I picked up on something else.

When Warren began digging deep into financial analysis and started investing in the market — his family came to him and decided to let him handle their surplus money. This is one of the ways in which he made his start, by managing a pool of finance from people close to him.

I paused right after that scene, turned to my girlfriend who was nice enough to not doze off during the documentary, and said “I can do this!”

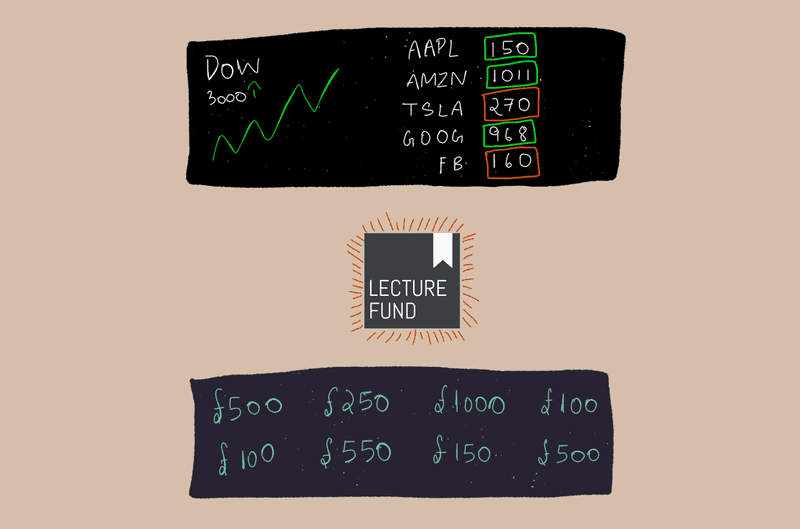

I had started investing in stocks in the first year of my university. I spent lectures monitoring the markets and reading about what companies were up to. A little over a year later I was doing decent, making annual returns in the range of 33–38% (higher than the industry average).

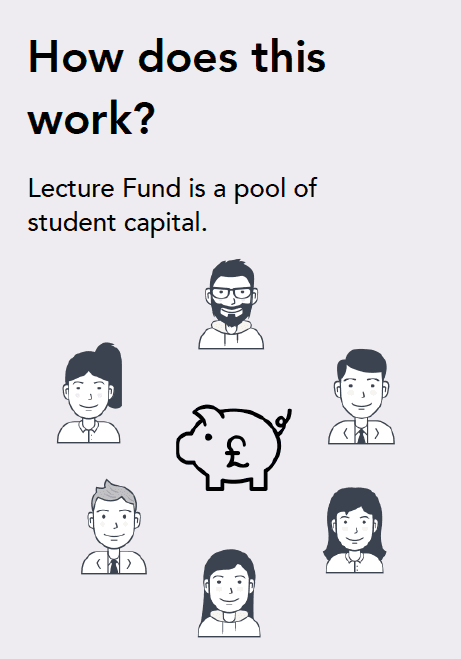

My friends knew that I traded stocks and had expressed interest in the past to get into it, but not much came of it. The big issue is that students don’t generally have a lot of knowledge about trading and neither do they know where/how to begin. Not to mention, the risks involved in going solo.

Now, I find myself paused at the documentary, my girlfriend looking at me innocently confused, it all came together! I could use my experience and extend that to other students who wanted to get involved in the market, without all the barriers they’d been facing (or some that just wanted to stash their savings).

Taking advice from Eric Reis in my head (author of Lean Startup), I decided to not fret too much over the details and just went for it. I called up few of my friends and asked if they were interested. I got a few yeses and a few rejections, but that’s okay, what matters is that I had enough people to make a start with (shoutout to my girlfriend who only invested because I’d sulk otherwise).

I whipped up a quick pdf to explain to potential investors how the fund would work and I tried to keep it really simple and transparent. You can check it out here.

Transparency is a cornerstone value for me and I try to bring it along in whatever I try to do. With Lecture Fund, ensuring that people understand how their money is being utilised was a priority for me.

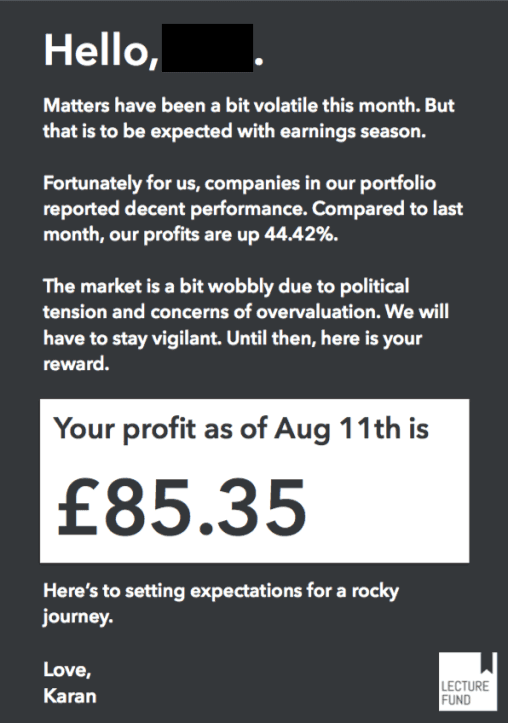

So, I created a Facebook group with all the investors. I posted a weekly update of profits and gave a summary of what happened in the market that week and how it impacted our portfolio.

In addition to this, each investor also got a personalised update from me at the end of each month.

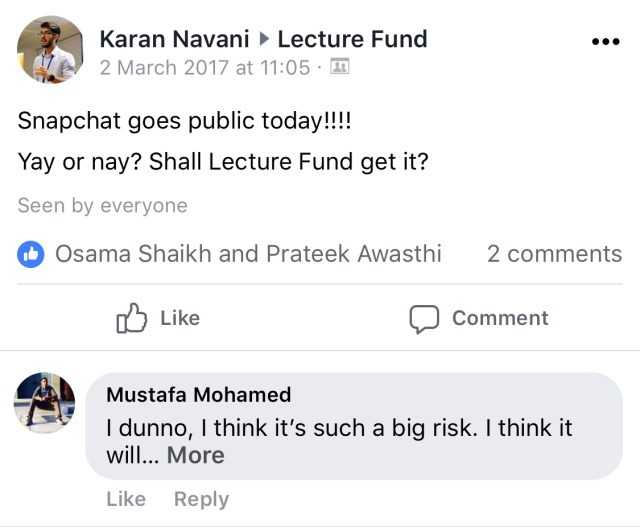

I also tried to keep the entire process of stock-picking democratic. Any time we had an influx of capital, a post would go out on the group asking for stock suggestions. I really wanted everyone to be engaged and feel in control over the whole thing.

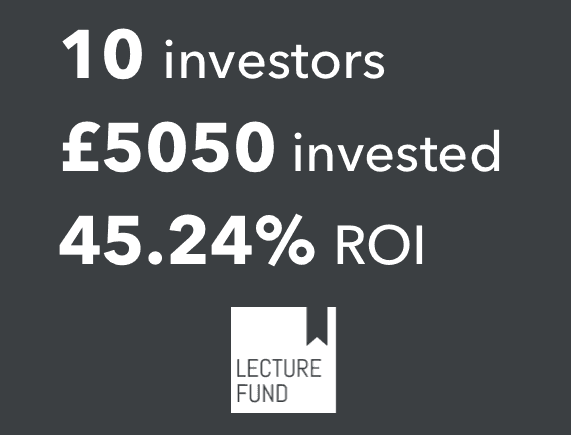

Now, Lecture Fund wasn’t something big and neither did I intend it to be. It’s scary to be trusted with other people’s money and I did not want to screw it up. I started the fund in February (2017) and ran it until December (2017). Below are some numbers which should give you better grasp of the performance.

Lecture Fund in numbers

The numbers were decent and I was enjoying myself, but eventually I decided to move on.

Why?

There are 2 key reasons:

- It was getting difficult for me to manage my job at IBM and also accommodate other aspects in my life which I wish to develop. Monitoring the market became more challenging and my updates would be delayed. Cutting corners was not the way to go. If I am being trusted with your money, it deserves the best treatment.

- By the time it was December, I only had 3 investors left. Most students had withdrawn their stake by this point. (I will elaborate on this in “Students and funds”below). It seemed futile to dedicate the same level of effort now, as I did when I had 70% more investors.

That’s not to say that I am over the whole investing thing. I still have my personal funds invested and my favourite time of the year is still when companies report their quarterly earnings. (HYPE!! 📊📈📉)

I had an absolute ball while doing this and I got to learn a lot. I would like to share some of those lessons with you.

- Dilemmas and patience — Investing requires you to be unemotional about your money, but when it’s the money of your friends, it makes things a bit tricky. You can imagine, returning a loss to your personal friend circle would be a bit awkward. I had to build up my patience and tolerance for market swings and I’m glad that my investors were understanding.

- Trend spotting and business understanding — When you read business news and start observing the market more critically, something interesting begins to happen. All of a sudden you find that you have a “gut feeling” about certain things and that increases in accuracy over time. Your brain keeps getting better at spotting patterns in the market that you would have otherwise missed. Your understanding of the brands around you are run also increases drastically. I think that’s a super-valuable skill to have.

- Transparency and accountability — Posting updates every week and having to constantly explain results allowed me to create accountability for myself. This in turn helped to drive trust with the investors.

- Personalisation — I believe that connecting with your clients on a personal level is critical if you want to be successful in business. While that gets increasingly difficult as you scale, an element of personal touch should be maintained throughout. It feels good to know that you’re looked after.

- Students and funds — Lastly, this one is a critical factor in why I decided to wind down the fund. Hedge funds normally take money from people who have plenty of savings and surplus capital and….students do not. It is challenging for a student to be able to park their capital long term. This made it tricky when I was trying to use the principles of value and compound investing, which plays out over a longer timescale but deliver immense value (shout out to my man Warren B).

The broker I used is DEGIRO. I found them to be pretty straightforward and fees were usually less than £1 for trades. I am always available for any questions or help that you may need with getting started so please reach out!

I hope this gave you a few valuable insights and remember, no one can know everything right off the bat. Just get started and I promise, it will come to you with experience and constant curiosity. Allow yourself to make mistakes and you will grow.

Special thanks to all the folks who trusted me with their money and allowed me the freedom to experiment and grow.

Until next time.

Karan

If you liked this post, might I recommend -